query regarding reporting in clause 18 of 3CD for change of block of assets

Problem

one of my client was having truck for transporting goods being sold by it. so, truck were classified in the block of 15%. but during the current year, it discontinued its old business, and started business of hiring truck. so, its block of asset was to be changed to 30%. So, I wanted a clear view how to present it in the clause 18 of the form 3CD.

Prompt Input

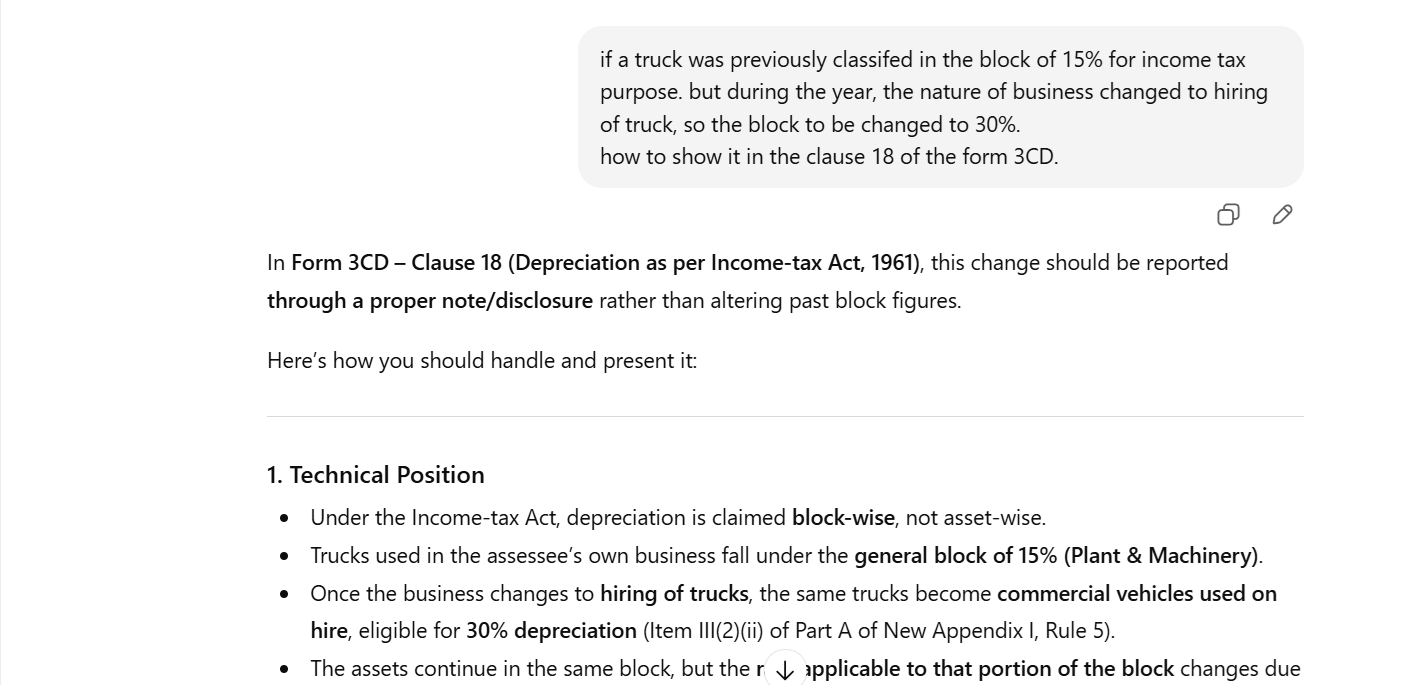

if a truck was previously classifed in the blocif a truck was previously classifed in the block of 15% for income tax purpose. but during the year, the nature of business changed to hiring of truck, so the block to be changed to 30%. how to show it in the clause 18 of the form 3CD. k of 15% for income tax purpose. but during the year, the nature of business changed to hiring of truck, so the block to be changed to 30%. how to show it in the clause 18 of the form 3CD.

Prompt Output

In **Form 3CD – Clause 18 (Depreciation as per Income-tax Act, 1961)**, this change should be reported **through a proper note/disclosure** rather than altering past block figures. Here’s how you should handle and present it: --- ### **1. Technical Position** * Under the Income-tax Act, depreciation is claimed **block-wise**, not asset-wise. * Trucks used in the assessee’s own business fall under the **general block of 15% (Plant & Machinery)**. * Once the business changes to **hiring of trucks**, the same trucks become **commercial vehicles used on hire**, eligible for **30% depreciation** (Item III(2)(ii) of Part A of New Appendix I, Rule 5). * The assets continue in the same block, but the **rate applicable to that portion of the block** changes due to change in use. --- ### **2. Computation Treatment** In your depreciation working: * Identify the **WDV of trucks** as on 1 April 20XX. * Transfer that WDV from the **15% block** to a new **30% block** as “being used for hiring business w.e.f. [date]”. * No revaluation or sale is recorded; it is a **transfer between blocks due to change in user**. --- ### **3. Disclosure in Clause 18 (Form 3CD)** In **Column (3)** – “Description of asset/block of assets”, you will now show two separate blocks: * Plant & Machinery (General – 15%) * Motor Lorries/Trucks used on hire – 30% In the **remarks column (Column 8)** or as a **note below Clause 18**, insert a clear explanatory note such as: > **Note:** During the year, the assessee changed the nature of business from trading/manufacturing to truck-hiring. Consequently, motor trucks earlier included in the 15% block have been transferred to the block of “Motor Lorries used in business of running them on hire” eligible for depreciation at 30% as per Item III(2)(ii) of Part A, Appendix I to Rule 5 of the Income-tax Rules, 1962. --- ### **4. Audit Comment** You may also include a brief observation in **Clause 21(a)** (if any adjustment affects P&L) or in the **Notes to Accounts** forming part of Form 3CB: > “Depreciation rate on motor trucks revised from 15% to 30% during the year consequent to change in nature of business to hiring of trucks.”