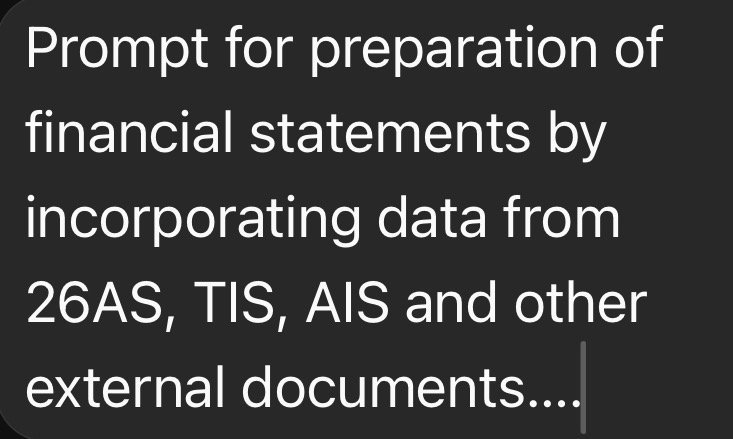

Financial statements preparation

Problem

Financial statements preparation for income tax filling

Prompt Input

Assume you are accounting expert. You have been provided with the last two Financials year's Financial statements of the concern person. From that Financial statement you are supposed to prepare financial statements for the year ending on 31/03/2025. For the preparation of Financial statement you should take into consideration as following, 1. You should prepare profit and loss account having debit and credit sides in one sheet 2. Balance sheet having Assets and liability side in one sheet 3. Capital Account having debit and credit side in one sheet You should consider bank balance as below You should consider loan balance as below You should consider investment holding value as per sheet attached All kind of Interest, dividend income should not be less than form number 26AS, AIS, TIS which is uploaded excel sheet You should also give emphasis on Income from business which should not be less than 26AS, AIS, TIS uploaded in excel file and It should also be more than business income of last Financial statement. Share market gain or loss should be as per pdf attached and it should be credited/ Debited to capital account instead of profit and loss account.

Prompt Output

Trading and profit-loss account, capital account and balance sheet for income tax filling.