AI Accounting Treatment Assistant – Ineligible GST on Prepaid Expenses

Problem

A company pays ₹1,20,000 for an annual insurance premium covering 12 months, and the invoice includes GST of ₹18,000. Since the company is engaged in exempt output services, the GST amount is not eligible for input tax credit under Section 17(5). At year-end, the accountant must decide the correct accounting treatment for the ineligible GST portion. The accountant now faces the following questions Should the ₹18,000 GST be fully expensed in the month of payment (either grouped under insurance expense or shown separately as a tax expense)? OR Should the GST portion be included in the prepaid balance and amortized over the 12-month insurance period? If amortized, should it be spread as part of the insurance expense or shown as a separate “tax expense amortization”? This practical confusion arises frequently in cases of prepaid insurance, AMC contracts, software subscriptions, and rent payments where GST is blocked or ineligible. The prompt helps the user determine the correct accounting treatment under Ind AS / IGAAP, showing how the GST amount should be recognized, how the prepaid portion must be split or grouped, and what journal entries and disclosures are appropriate for financial reporting.

Prompt Input

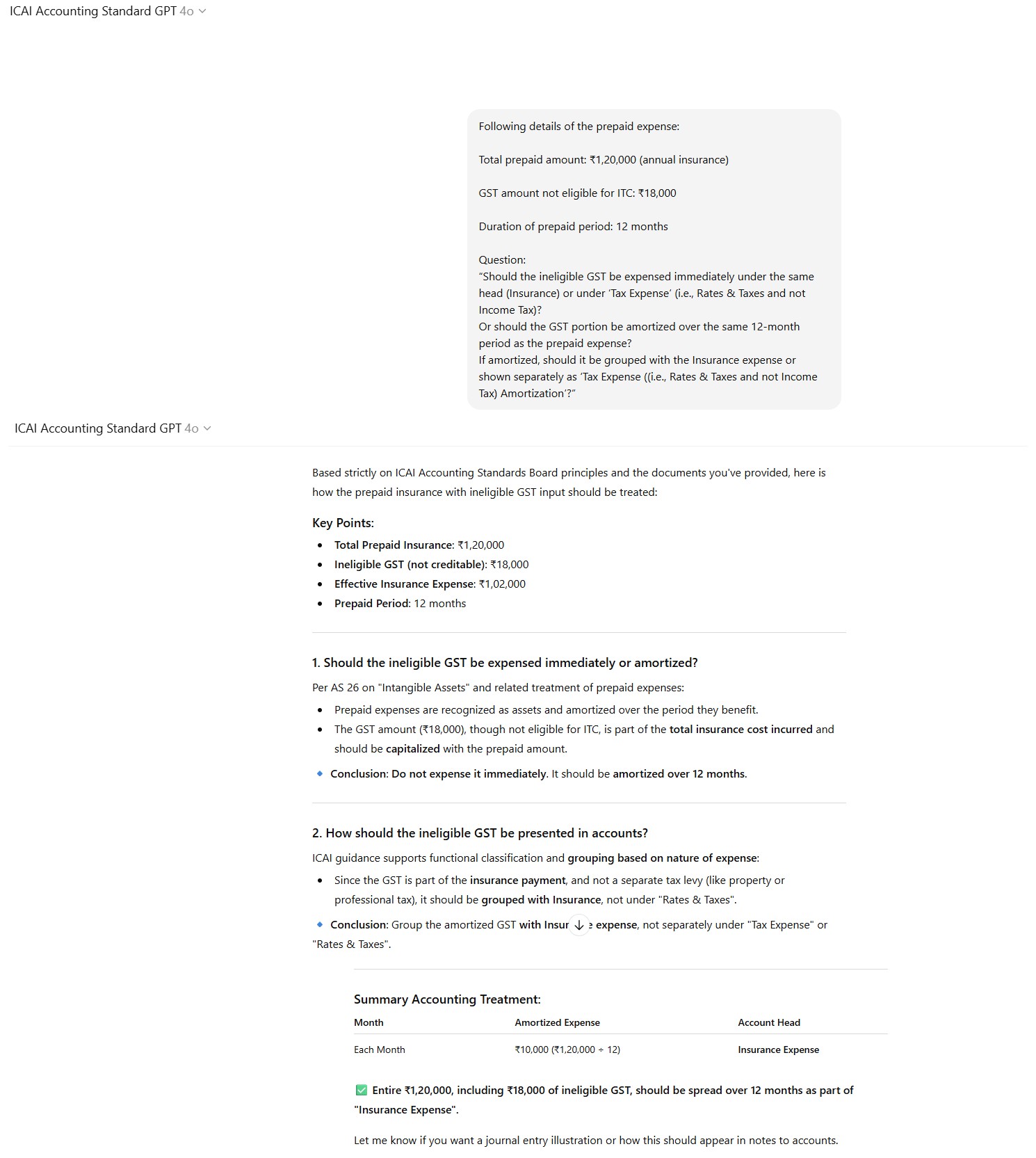

Following details of the prepaid expense: Total prepaid amount ₹1,20,000 annual insurance GST amount not eligible for ITC , ₹18,000) Duration of the prepaid period ( 12 months) “Should the ineligible GST be expensed immediately under the same head (Insurance) or under Tax Expense? Or should the GST portion be amortized over the same period as the prepaid expense (i.e., 12 months)? If amortized, should it be grouped with the Insurance expense or shown separately as ‘Tax Expense Amortization’?” Note : here Tax expense means not income tax -Other tax head like rates and taxes

Prompt Output

1. Clear Accounting Conclusion Based on ICAI Accounting Standards Board principles, the AI should conclude that: • The ineligible GST of ₹18,000 is part of the total insurance cost, even though ITC is not available. • It should not be expensed immediately. • It must be amortized over the prepaid period of 12 months, along with the insurance premium. 2. Basis Under Standards The AI should explain that: • Prepaid expenses are recognized as assets and amortized over the period they provide benefit. • Blocked GST becomes part of the cost of the related service when ITC is not available. • Therefore, the GST amount must be capitalized with the prepaid insurance and amortized over 12 months. 3. Presentation Guidance The AI should clarify that: • Since GST relates to the insurance service, it should be grouped under Insurance Expense. • It should not be shown under “Rates & Taxes” or any other tax head. • Amortized GST should therefore be included in the functional expense classification of Insurance. 4. Journal Entries The AI should provide sample journal entries for: • Initial recognition of prepaid insurance including ineligible GST. • Monthly amortization of the prepaid amount over 12 months. 5. Amortization Example The AI should illustrate with the example provided: • Total prepaid insurance: ₹1,20,000 • Ineligible GST: ₹18,000 • Total cost: ₹1,38,000 • Period: 12 months • Monthly amortization: ₹11,500 A simple amortization line/table should be shown. 6. Final Summary The AI should conclude that the entire amount, including the ineligible GST, must be amortized over the 12-month period and recognized monthly as part of Insurance Expense, not as a separate tax expense.